Markets in focus

WTI crude oil has remained in a consolidation phase for over a year, with a significant resistance level in the 82 – 84 range.

After a wild ride in 2022, the Henry Hub natural gas has been trading below 3 for the better part of 2023, almost an 80% decline from the 2022 high. Nevertheless, recent patterns hint at a potential breakout on the horizon.

Metals’ performance has been lackluster despite the recent US dollar downturn and an upbeat equity market. Silver is hovering near the base support of an ascending channel, coinciding with a significant long-term support level at approximately 22.

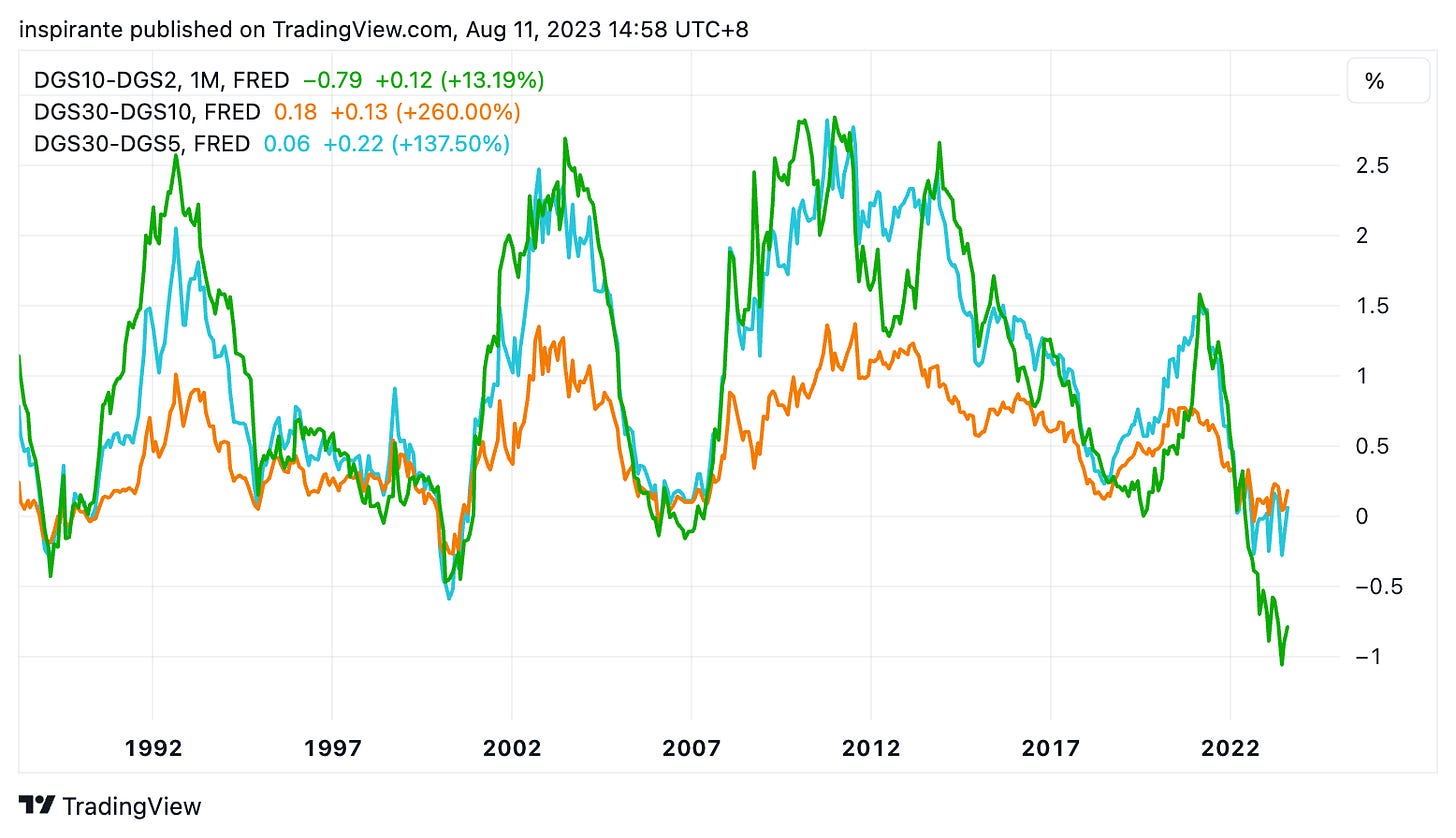

The belly to the long end of the US yield curve has stopped inverting further, showing signs of steepening, as evidenced by the 5y30y and 10y30y curves. However, the front to the belly of the curve, as shown by the 2y10y, which generally lags slightly, is still deeply inverted.

Our market views

When observing the relentless optimism of equity markets, even as traditional bears capitulate, one can’t help but question the prudence of entering the fray right now. Decades of accommodating monetary policies have entrenched the “Buy-the-dip” mentality, further emboldened by the recent rally in US equities. However, as we cautioned our readers over a year ago, the current macro regime has changed drastically compared to the past decade. In the much-changed macro regime, we recognize the risks in sticking to a mindset deeply ingrained in our investment decisions and the value of staying nimble.

Meanwhile, the soft commodities market remains highly volatile. Recent swings in agricultural commodities have been striking, underscoring the need to measure returns in the context of volatility rather than purely on absolute terms. This focus on volatility-adjusted returns casts the current state of the soft commodities market in a less favorable light.

Yet, opportunities exist, often in overlooked spaces, such as the energy sector. Instruments like WTI crude oil and natural gas have been in a consolidative “basing” phase for nearly a year. Historically, extended periods of consolidation tend to precede significant price breakouts. For instance, silver was stuck in the range between 14 – 20 for six years, and when the breakout finally happened in 2020, it went from 18 to 30 in a matter of weeks.

To capitalize on this potential breakout in the energy sector, we advocate for using the “ratio call” strategy. This is slightly more intricate than outright calls or call spreads. Here’s the premise: We hypothesize that once an asset breaks out from a key resistance level after a long period of consolidation, it will sustain this momentum, surging a lot further. The ratio aspect ensures our profits from the higher strike calls bought outweigh any losses from the nearer strike ones sold. This strategy often incurs minimal upfront costs, given that we sell the more expensive nearer calls to finance purchasing the cheaper further ones. Should prices reverse at the resistance level, the potential loss is just the initial setup cost as both legs expire worthless. What’s more? Ratio calls have the edge over simple call spreads, offering the potential to maximize gains from extended rallies, which call spreads can’t capture beyond the higher strike level.

In summary, the ratio call strategy remains our preference for markets with a decent potential for explosive upward movement. And currently, the energy sector seems poised for such a trajectory.

How do we express our views?

We consider expressing our views via the following hypothetical trades1:

Case study 1: short WTI crude oil ratio calls

We would consider taking a short position on WTI crude oil ratio calls. We could sell one crude oil September 2023 call option with strike price 83 (LOU3 83C) at 1.22 points and buy two LOU3 84C at 0.78 points. The setup cost of the ratio calls is 0.78 x 2 - 1.22 = 0.34 points. Looking at Figure 1, if WTI crude oil continues the rally and moves beyond 84 + (84 – 83) + 0.34 = 85.34 by the option expiry, the strategy will be in profit. The maximum loss happens when the underlying settles at 84 by option expiry, and the potential loss amount is (84 – 83) = 1 point. A WTI crude oil option contract represents 1,000 barrels of oil; each point move is USD 1,000. Investors could also consider WTI weekly options to trade or hedge specific event risks (such as OPEC announcements and Wednesday EIA reports).

Case study 2: short natural gas ratio calls

We would consider taking a short position on natural gas ratio calls. We could sell one natural gas September 2023 call option with strike price 2.7 (ONU3 2.7C) at 0.171 points and buy two ONU3 2.8C at 0.123 points. The setup cost of the ratio calls is 0.123 x 2 – 0.171 = 0.075 points. Looking at Figure 2, if natural gas continues the rally and moves beyond 2.8 + (2.8 – 2.7) + 0.075 = 2.975 by the option expiry, the strategy will be in profit. The maximum loss happens when the underlying settles at 2.8 by option expiry, and the potential loss amount is (2.8 – 2.7) = 0.1 point. A natural gas option contract represents 10,000 MMbtu of natural gas; each point move is USD 10,000. Investors could also consider natural gas weekly options to trade or hedge specific event risks.

Original link here.

EXAMPLES CITED ABOVE ARE FOR ILLUSTRATION ONLY AND SHALL NOT BE CONSTRUED AS INVESTMENT RECOMMENDATIONS OR ADVICE. THEY SERVE AS AN INTEGRAL PART OF A CASE STUDY TO DEMONSTRATE FUNDAMENTAL CONCEPTS IN RISK MANAGEMENT UNDER GIVEN MARKET SCENARIOS. PLEASE REFER TO FULL DISCLAIMERS AT THE END OF THE COMMENTARY.