Commodities comeback

Written on 2024-09-21, first published on 2024-09-24

Markets in focus

The AUD/USD pair has been consolidating in a symmetrical triangle formation since early 2023. It is now on the verge of an upside breakout, driven by broad U.S. dollar weakness following the Fed’s first rate cut in this cycle.

The USD/CNH has weakened significantly, defying expectations of continued Renminbi depreciation due to China’s economic challenges. The pair has broken a multi-year ascending trendline, and historical precedence suggests further CNH strength could follow.

Crude oil prices have continued to decline, falling below the $70 mark. Sentiment and positioning in the energy market remain highly skewed as recession fears loom. However, the price found support at a critical technical level, indicating a potential reversal.

After a volatile journey from sub-$1,000 to $3,200 and back, palladium prices have found support and are showing signs of a reversal to the upside.

Our market views

At the most anticipated FOMC meeting of the year, the Federal Reserve (Fed), after hiking the Fed Funds Rate by over 5% in less than 18 months and then holding it steady for another year, has finally initiated a 50bps rate cut. This marks the formal start of the rate-cutting phase in the current cycle, bringing the policy rate into a less restrictive stance.

Throughout the press conference, Chairman Powell repeatedly emphasized, “The U.S. economy is in a good place, and our decision today is designed to keep it there.” The equity market reacted positively to both the larger-than-expected rate cut (with pre-meeting consensus split between 25bps and 50bps) and Powell’s reassurance that a recession is not imminent.

With the long-awaited rate cut now in place, the immediate concern for many investors is the U.S. dollar. As interest rate differentials between the U.S. and other countries begin to narrow, the Dollar Index has dropped more than 5% since July. This weakness is reflected across a broad range of currencies, including the AUD, EUR, JPY, and CNH. We believe we are at a significant macroeconomic inflection point, and U.S. dollar weakness will likely persist for months to come. Opportunities emerge in the shifted macroeconomic paradigm over the next 3-6 months.

Commodities, particularly energy, agriculture, and industrial metals, have borne the brunt of recession fear. The commodity markets have priced in a significant risk of economic slowdown in the U.S., compounded by China’s sluggish outlook, leading to muted demand expectations. However, we believe the market may have become overly pessimistic, failing to account for the macro shift already underway. The effects of rate cuts and a weaker U.S. dollar on commodities are not yet fully reflected in prices.

Fast-backward to the 2007 rate-cutting cycle: following the first rate cut, crude oil surged over 100% in the subsequent 12 months, gasoline by 100%, corn by 140%, wheat by 130%, soybeans by 96%, palladium by 80%, platinum by 86%, and copper by 25%. Even during the 2008 financial crisis, while commodities eventually retreated, the initial rallies presented tremendous opportunities for investors with the right macro outlook and time horizon. In other words, we’re not suggesting that recession risks have vanished, but the commodity market has underestimated the initial impact of this rate-cutting and dollar-weakening cycle. We believe significant opportunities are emerging as a result.

Moreover, as the U.S. begins to ease its monetary policy, China may find it more feasible to introduce stimulus without exerting excessive pressure on its currency. Thus far, China has been cautious with stimulus due to the risk of a substantial Renminbi depreciation while U.S. rates were elevated. With the dollar now weakening, China could stimulate its economy without as much concern for currency devaluation. Given the current bearish sentiment and market positioning towards China, any such stimulus could catch many investors off guard, providing yet another potential catalyst for a commodities rally.

How do we express our views?

We consider expressing our views via the following hypothetical trades1:

Case Study 1: Long AUD/USD Futures

We would consider taking a long position in the AUD/USD futures (6AZ4) at the current price of 0.682, with a stop-loss below 0.674, a hypothetical maximum loss of 0.682 – 0.674 = 0.008 points. Looking at Figure 1, if the breakout from the triangle is confirmed, the AUD/USD rate has the potential to reach 0.72 and subsequently 0.75, resulting in 0.72 – 0.682 = 0.038 and 0.75 – 0.682 = 0.068 points. Each AUD/USD futures contract represents 100,000 AUD, and each point move is 100,000 USD. E-mini and Micro AUD/USD futures contracts are also available at ½ and 1/10 of the standard size.

Case Study 2: Long Palladium Futures

We would consider taking a long position in the palladium futures (PAZ4) at the current price of 1078, with a stop-loss below 900, a hypothetical maximum loss of 1078 – 900 = 178 points. Looking at Figure 4, if the reversal at the long-term support level continues, palladium price has the potential to reach 1600 and subsequently 2400, resulting in 1600 – 1078 = 522 and 2400 – 1078 = 1322 points. Each palladium futures contract represents 100 troy ounces, and each point move is 100 USD.

The Rearview Mirror

A look into history could help us position ourselves better for the future. This section provides a rundown of market moves across major asset classes between July and September.

The Dow Jones Industrial Average (DJIA) recovered from the early August selloff and has pushed to new all-time highs, continuing its bullish momentum.

The Russell 2000 Index has remained within its ascending channel since the start of the year but is facing major resistance near the 2,300 level, which could act as a significant hurdle for further upside.

A sharp sector rotation from the tech-heavy Nasdaq to the small-cap Russell 2000 is evident, as shown by the sharp reversal in the ratio. However, on a historical basis, the ratio remains elevated, even surpassing the peak of the Dot-Com bubble.

The Japanese Yen has appreciated significantly against the U.S. dollar since the Bank of Japan’s July rate hike. The pair is now testing overhead resistance, and a breakout would signal further Yen strength as Japan continues to normalize monetary policy.

The GBP/USD has broken out of a 17-year descending trendline resistance, benefiting from broad-based U.S. dollar weakness.

The EUR/USD is nearing a breakout from its 17-year descending channel, as the Euro strengthens against a weakening U.S. dollar.

The EUR/GBP pair is approaching a key 8-year support level. A break below this level would complete a rounding top pattern, indicating further potential upside for the British Pound against the Euro.

Corn prices have plummeted from recent highs above 800 and are now approaching the 300 level, which has acted as a strong support for nearly a decade.

Soybean prices have fallen sharply from 1,800 to below 1,000 and are nearing a decade-long support level of around 800.

Gold has continued its bullish thrust following a period of consolidation, making it the strongest performer among precious metals.

Silver lags behind gold and remains in consolidation. While the overall trend remains upward, silver must break through overhead resistance around 32 to confirm its next move higher.

Gasoline prices have dropped to a multi-year support level, mirroring crude oil. A reversal from this level seems increasingly likely.

The spread between the U.S. 2-year yield and the Fed Funds Rate is at its lowest level in four decades. The 2-year yield reflects market expectations for interest rates over the next two years; when it is significantly lower than the current short-term interest rate (Fed Funds Rate), it means investors expect interest rates to be much lower in the near future than they are now.

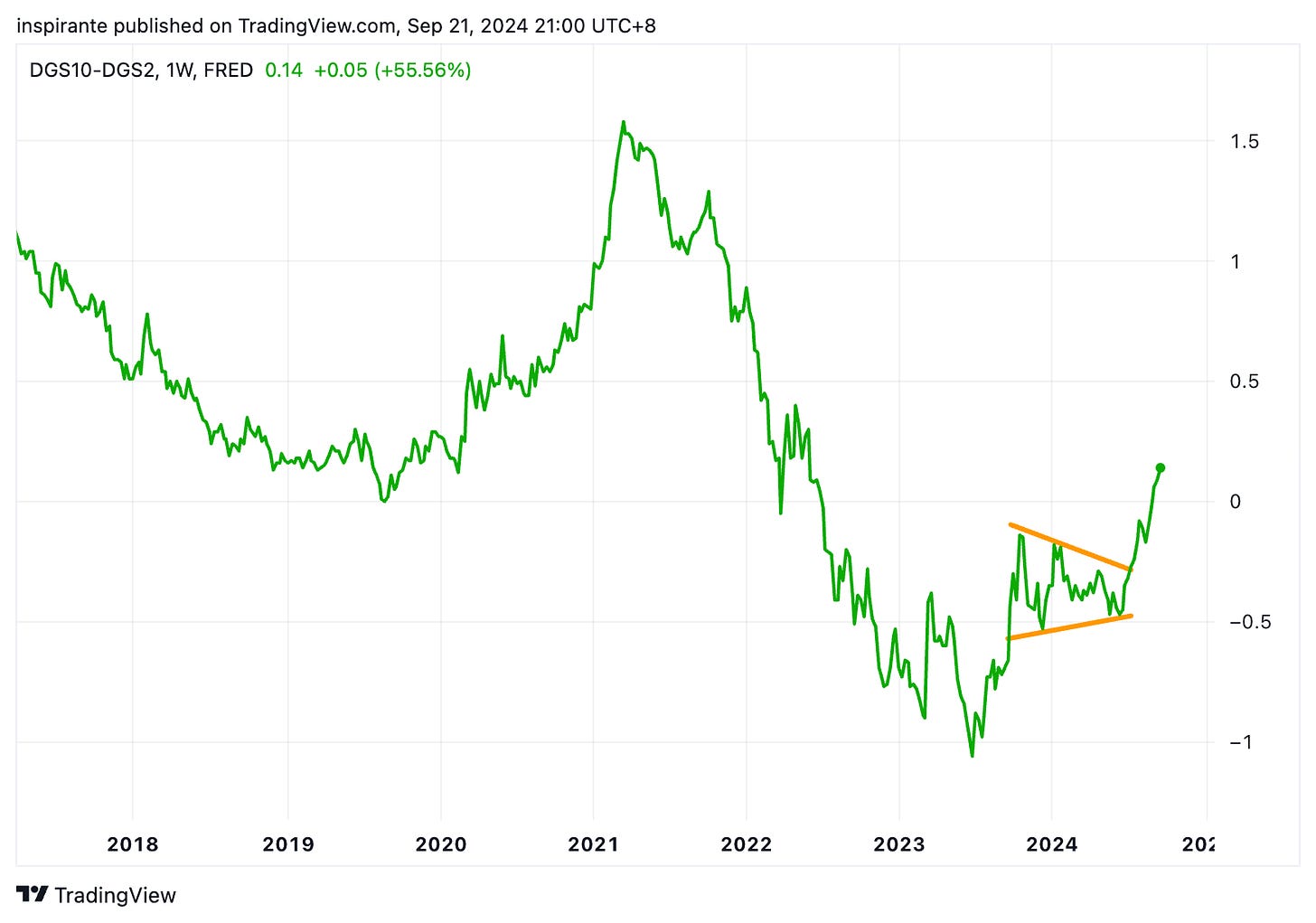

After one of the longest inversions in history, the U.S. 2y10y treasury yield spread has finally un-inverted. This bull steepening, where short-term rates drop faster than long-term rates, often signals an impending economic slowdown or recession.

Original link here.

EXAMPLES CITED ABOVE ARE FOR ILLUSTRATION ONLY AND SHALL NOT BE CONSTRUED AS INVESTMENT RECOMMENDATIONS OR ADVICE. THEY SERVE AS AN INTEGRAL PART OF A CASE STUDY TO DEMONSTRATE FUNDAMENTAL CONCEPTS IN RISK MANAGEMENT UNDER GIVEN MARKET SCENARIOS. PLEASE REFER TO FULL DISCLAIMERS AT THE END OF THE COMMENTARY.