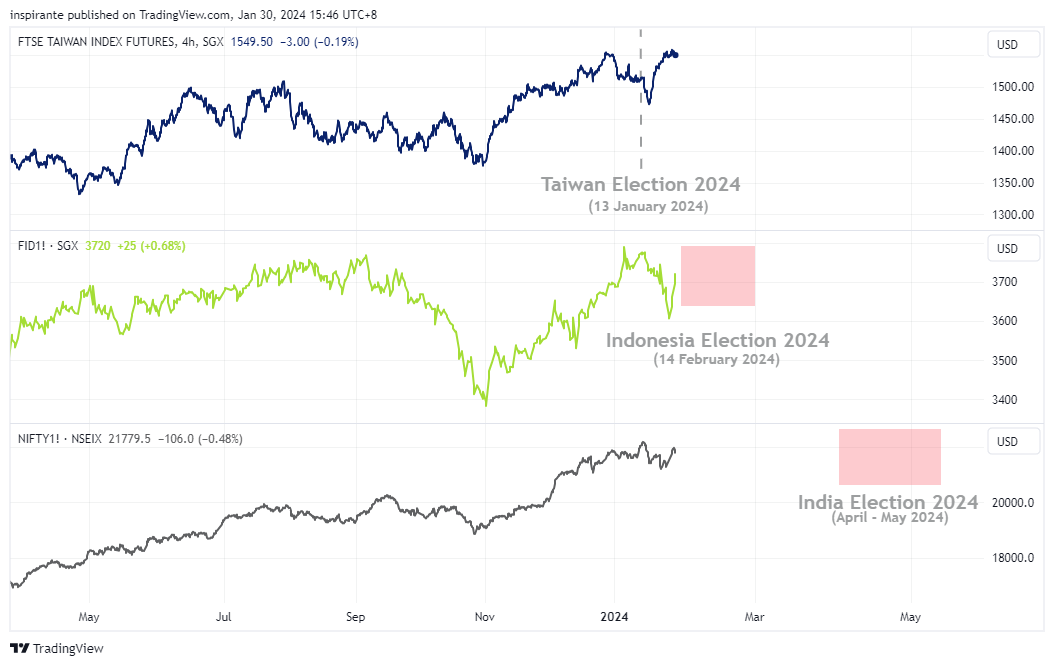

Election season is here, and on the calendar we have:

Taiwan (13 Jan 2024)

Indonesia (14 Feb 2024)

India (April – May 2024)

US (November 2024)

Elections often usher in a blend of uncertainty and opportunity, which manifests in market behavior leading up to and following the election dates.

The recent Taiwan election offers insights into the electoral influence on stock markets. A discernible pattern of pre-election price dips and post-election corrections highlights the interplay of investor sentiment during these periods, characterized by heightened volatility and the market's search for equilibrium.

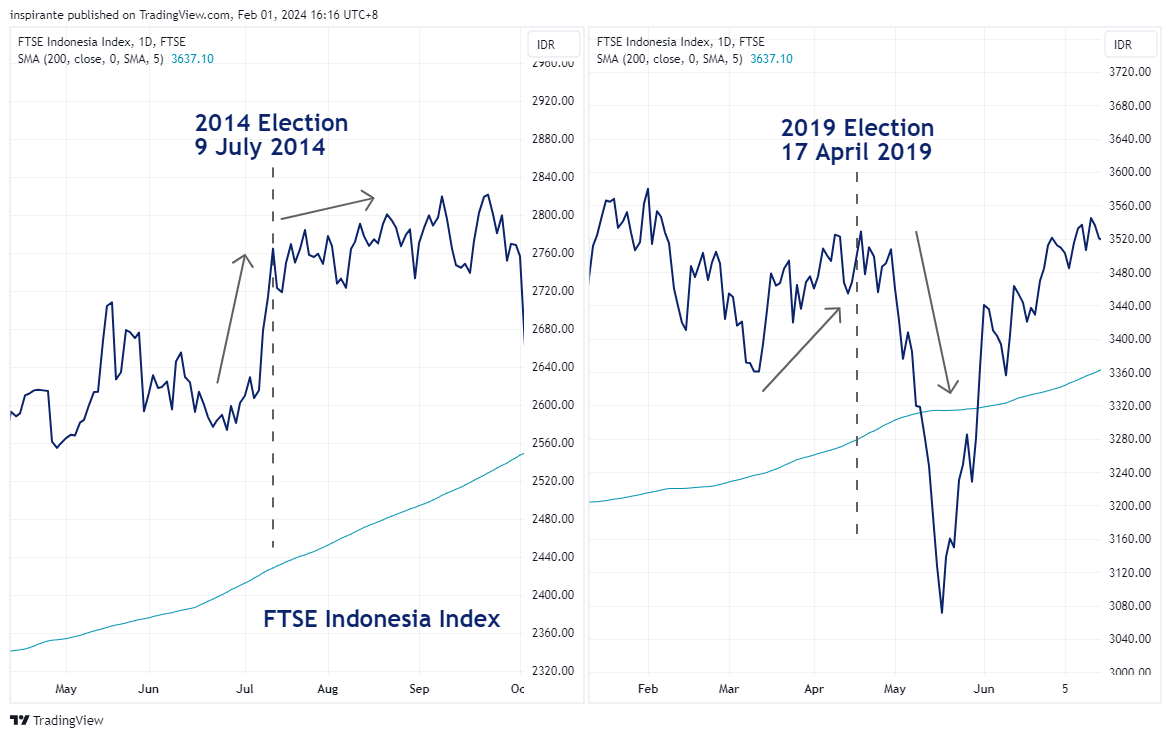

With Indonesia next on the calendar for the election. We see choppy trading as well with the past 2 elections showing a runup prior to the election date , followed by a divergence in direction—with 2014 seeing an increase and 2019 a sharp decline.

The FTSE Indonesia Index's multiyear ascending triangle formation signals potential bearish reversals. Recent price actions, testing both the triangle's support and short-term resistance, suggest the possibility of an emerging downtrend.

The EM VS DM theme viewed from the lens of the S&P500 Index vs the FTSE Indonesia Index, has been trending upward. The ratio has largely adhered to its trend line, except for a significant deviation during the 2020 pandemic. Currently, as the ratio creeps above its trend, it poses the question: Is this indicative of the US market stretching or underperformance by the Indonesian Index?

With Indonesia and India—the world's largest and third-largest democracies—approaching their election dates, their diverging indices are reflected in the ratio of the Nifty 50 Index to the FTSE Indonesia Index, which has now returned to levels last seen in September 2022.

The dispersion of performance within various Asian equity indices further underscores the strength and momentum of Indian equities. Compared to the Indonesia Index, the ratios of the Nifty 50 Index Futures to both the China A50 Index and Singapore Index suggest significant relative headroom.

What’s inside our playbook?

The first half of the year, marked by the election season for two of the largest democracies, typically stirs volatility as markets anticipate the elected parties' potential reforms and focus areas.

For Indonesia, the 2024 general elections are shaping up to be a pivotal moment, as the outgoing president will not be eligible for re-election having served two consecutive terms, necessitating a change in leadership. Leading the race is the current Defence Minister, Prabowo Subianto, who is running for president for the third time, is aligning himself with the policies of the current administration to capitalize on its successes. His running mate, Gibran Rakabuming Raka, the son of the current president Jokowi, also suggests a bid to maintain continuity in governance. However, it can also be seen as a move that might instigate changes within the current political alliances and could create uncertainty in the political landscape, potentially impacting investor sentiment and market stability.

Technically, the FTSE Indonesia Index's formation of a multiyear ascending triangle may signal a bearish reversal, particularly if support levels are breached. This pattern, combined with possible election-induced volatility, presents an opportunity for a tactical short position in Indonesian equities.

Fundamentally, significant policy shifts or delays in infrastructure project continuations could sway the market. The election outcome might affect Indonesia's commodity-centric economy; a departure from current policies could impact key sectors like infrastructure and commodities. More importantly, any shifts in political stability may halt the flows of significant Foreign Direct Investments that Indonesia receives.

Conversely, Indian market sentiment is bullish in the lead-up to its 2024 elections. The prospect of the current government, led by Prime Minister Narendra Modi, retaining its majority is expected to reinforce investor confidence and sustain reform momentum, potentially benefitting the Indian stock market.

India's focus on digitalization and infrastructure, along with robust domestic consumption, are key drivers of its economic growth narrative. The economy's resilience, despite global headwinds, reinforces a positive long-term outlook for Indian equities. This point is further evident by its YOY GDP figure still hovering around 7.6%, an incredible feat considering the performance of other neighbouring nations. Moreover, the anticipation of continued pro-business policies could attract more foreign capital inflows, amplifying investment opportunities and justifying a long position on Indian equities.

Stepping back from the election focus, comparing the performance of the Indonesian and Indian Index against each other as well as other Asian indices highlights the momentum and outperformance of Indian equities. In our September piece covering India, we highlighted the supportive economic environment and central bank as key to India’s outperformance. We see a potential continuation of this backdrop and hence the bullish lean on India. The ratio of Nifty 50 Index to the FTSE Indonesia Index which is on the cusp of breaking the previous highs, alongside the technically bearish pattern on the FTSE Indonesia could propel the ratio higher. Further, the relatively muted rise compared to the Nifty 50 Index vs the MSCI Singapore Index or China A50 Index point towards potential headroom.

Executing the plays

A hypothetical investor can consider the following two trades1 :

Case Study 1: Short SGX FTSE Indonesia Index Futures (FID)

We would consider going short the SGX FTSE Indonesia Index Futures (FID) on the development of the multi-year ascending triangle, which generally signifies a bearish reversal. Entering a short position in the buildup to pre-election volatility may provide an advantageous average entry point. From the current level of 3740, stop at 3800 and take profit at 3500 provides a reasonable risk-reward. Each 1-point move in the FID contract is 5 USD.

Case Study 2: Long NSE IFSC Nifty 50 Index Futures (GIN), Short SGX FTSE Indonesia Index Futures (FID)

Alternatively, we would also consider taking a long position on the ratio of the Nifty 50 Index to FTSE Indonesia Index. This provides another way to express the bearish view on the FTSE Indonesia Index alongside capturing the momentum of the Nifty 50 Index. To roughly match the notional value of both contracts, 2 (FID) : 1 (GIN) ratio is used in sizing the trade. A long at the current ratio of 5.84, stop at 5.54 and the take profit at 6.74 , could capitalize on the diverging performance of the two markets. Each 1 point move in the FID contract is 5 USD while a 1 point move in GIN is 2 USD.

Original Link: https://www.sgx.com/research-education/market-updates/20240131-derivatives-traders-playbook-navigating-election-season

Examples cited above are for illustration only and shall not be construed as investment recommendations or advice. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios.