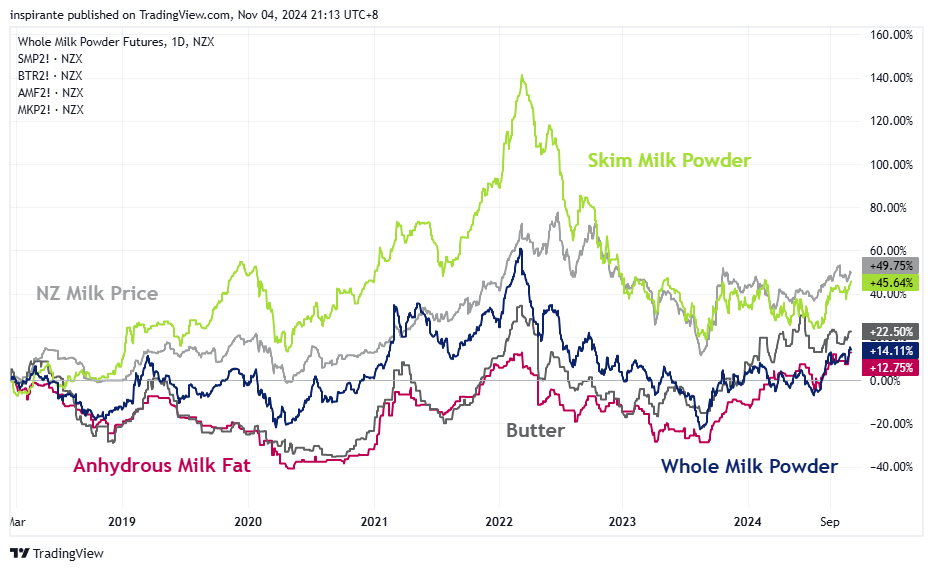

SGX lists a range of dairy futures products, including Whole Milk Powder (WMP), Skim Milk Powder (SMP), Anhydrous Milk Fat (AMF), Global Butter(BTR), and NZ Milk Price (MKP) Futures. These futures contracts offer market participants insights into forward pricing in the dairy market and enable effective risk management by hedging against potential price fluctuations. With growing trading volumes, SGX's dairy futures have become an increasingly reliable tool for gauging market sentiment and price expectations in the dairy sector.

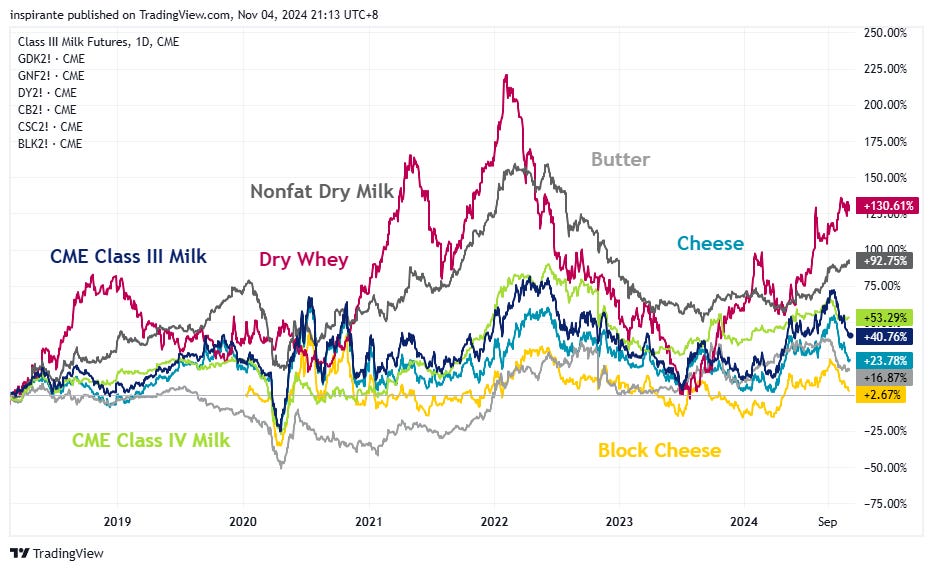

The CME also provides a suite of dairy futures, with Class III Milk Futures being the most actively traded contract. Class III Milk is mainly used in cheese production, particularly cheddar, making it highly relevant for participants involved in U.S. dairy and cheese production. CME's dairy futures complement SGX’s offerings by providing a view of the North American dairy market, which often contrasts with or complements the Asia-Pacific perspective reflected in SGX-NZX contracts.

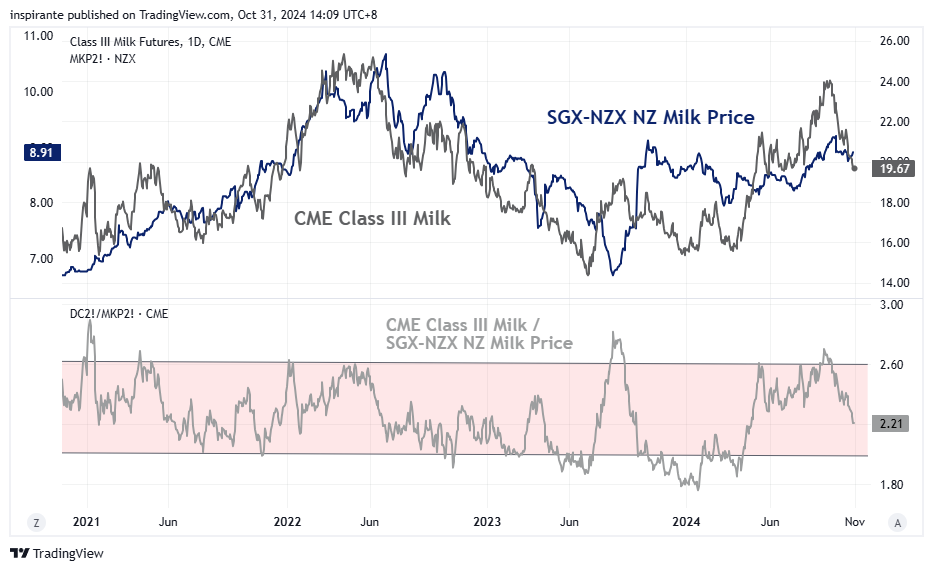

Despite covering different regions, SGX-NZX NZ Milk Price Futures and CME Class III Milk Futures show strong price correlation, reflecting the global nature of the dairy market. Their price ratio has remained within a defined range over the past four years, offering traders a view on relative value and potential arbitrage opportunities.

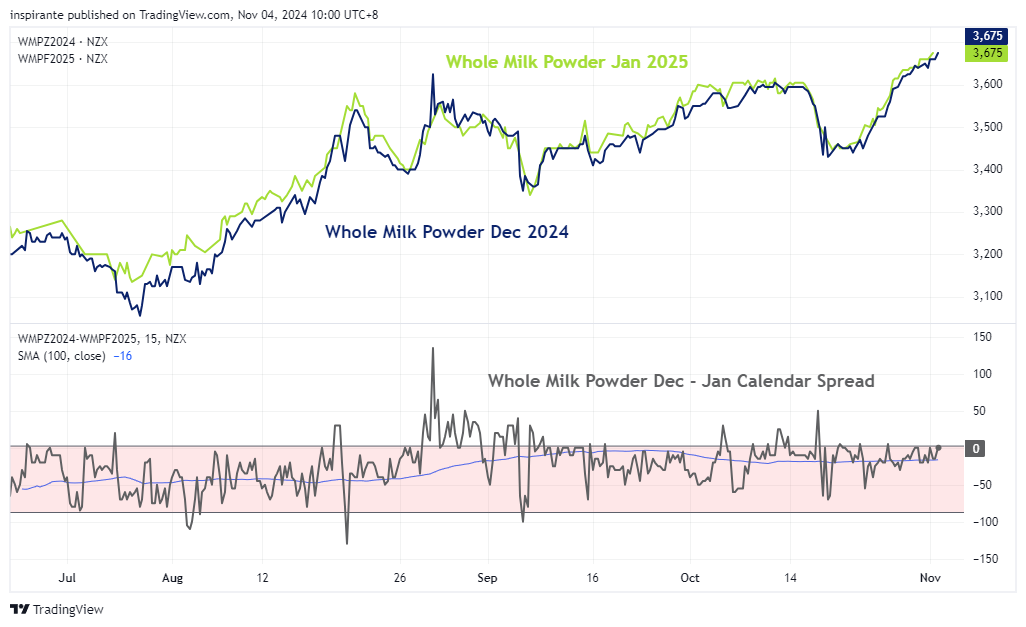

Calendar spreads in dairy can reveal market dynamics. Typically, the dairy market shows a contango structure—longer-term contracts priced higher than near-term ones. However, disruptions to this structure provide potential opportunities for traders to bet on the spread normalizing or widening.

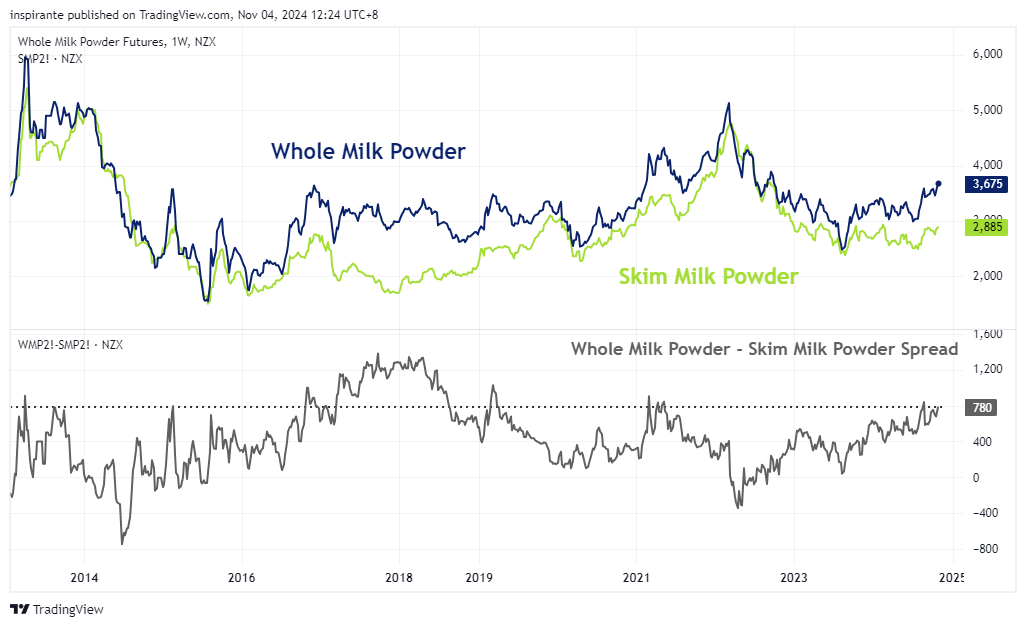

SGX is the only exchange that offers the WMP derivatives contracts. WMP generally trades at a premium over SMP due to higher fat content and broader applications, driven by consumer demand. This spread can highlight trends in consumer preferences and production changes, presenting opportunities within the dairy market.

The typical premium of SGX-NZX SMP over CME's Nonfat Dry Milk (NFDM) reflects regional cost and demand differences. Recently, this premium has dipped into the negative, signaling potential shifts in the market and offering relative value opportunities for traders in both the Asia-Pacific and North American markets.

What’s inside our playbook?

The dairy market might not receive as much attention as other commodities, yet it plays a significant role in the global economy and in our everyday lives. Dairy products are widely used, from household staples like milk and cheese to ingredients in processed foods and even industrial applications. According to estimates, the dairy industry is valued at around USD 631 billion, highlighting its importance in the global marketplace. In this article, we aim to provide a straightforward introduction to the dairy market and its unique characteristics, while acknowledging its underlying complexity.

SGX and CME Dairy Futures

Dairy markets have grown increasingly accessible to traders and businesses through exchanges like the Singapore Exchange (SGX) and the Chicago Mercantile Exchange (CME). These exchanges offer futures contracts on a variety of dairy products, allowing participants to gain price transparency, manage risks, and take positions based on their market outlook.

SGX Dairy Complex: SGX lists a range of dairy futures in partnership with the New Zealand Exchange (NZX), focusing on products like Whole Milk Powder (WMP), Skim Milk Powder (SMP), Anhydrous Milk Fat (AMF), and Global Butter (BTR), as well as New Zealand (NZ) Milk Price (MKP) Futures. These contracts primarily reflect prices relevant to the Asia-Pacific region, where New Zealand is a dominant dairy exporter, particularly to markets like China.

CME Dairy Futures: In the United States, CME offers its own suite of dairy futures, with Class III Milk and Class IV Milk Futures being among the most popular. Class III Milk Futures are linked closely to cheese production, especially cheddar, while Class IV Milk Futures are often associated with products like butter and nonfat dry milk. These contracts primarily reflect Western market prices and U.S. domestic supply and demand conditions.

A unique feature of the dairy market is the range of spread trades available, allowing participants to trade the difference between related products or between different exchanges:

Calendar Spreads: In many commodity markets, including dairy, prices for futures contracts are often in "contango," where contracts with later expiration dates are priced higher than those with nearer expiration dates. This price structure reflects costs associated with storage, financing, and sometimes expected future demand. In the case of dairy, Whole Milk Powder (WMP) futures often show a contango structure. For example, the WMP futures for December 2024 and January 2025 in Figure 4 display January prices slightly above December, likely reflecting an expectation of stronger demand in the New Year. Seasonal factors, such as higher milk product consumption in colder months, also contribute to this upward price trend.

Periods where this typical contango structure breaks, such as during supply disruptions or unusual demand patterns, create unique trading opportunities. Traders who anticipate a return to the normal contango structure may engage in calendar spread trades—buying the near contract and selling the further contract, or vice versa. This strategy allows them to benefit from the price convergence as the market normalizes.

Product Spreads: Another form of spread trading in the dairy market involves the price relationship between different but related products, such as Whole Milk Powder (WMP) and Skim Milk Powder (SMP). Historically, WMP trades at a premium to SMP due to its higher fat content, which consumers tend to prefer for its richer taste and versatility in food production. WMP's higher fat content makes it desirable for a wide range of applications, from consumer products to processed foods, while SMP's lower fat content limits its uses.

This premium creates a typical price gap between WMP and SMP. However, during periods of unexpected supply shortages or surges in demand for lower-fat products, SMP prices may briefly rise above WMP. Such occurrences are often temporary, as supply and demand forces tend to bring prices back to their historical relationship. For traders, these short-term anomalies in the WMP-SMP spread present mean-reversion opportunities, where they can trade with the expectation that prices will revert to their usual alignment.

Inter-Exchange Spreads: Dairy products are traded on multiple exchanges, each reflecting the unique regional supply and demand dynamics of its market. For instance, SGX offers futures reflecting the Asia-Pacific market in partnership with NZX, while CME focuses on the U.S. market. Similar dairy products, such as Skim Milk Powder, are available on both exchanges, but regional factors—such as production costs, regulatory policies, and demand patterns—often lead to price discrepancies.

On a USD per Metric Tonne basis, the SGX-NZX SMP has historically traded at a premium to CME NFDM. Recently, however, this spread has shifted into the negative, reflecting changing dynamics between the regions.

For traders, these inter-exchange spreads offer a way to leverage regional price movements. By taking long positions on one exchange and short positions on another, they can capitalize on the relative price differences. Inter-exchange spreads are especially useful for those who closely follow regional dairy market developments and are positioned to benefit from the convergence or divergence in these prices.

In addition, the dairy market is influenced by a variety of factors that can cause price fluctuations, making it important for participants to stay informed:

Supply Chain Complexities: Dairy production is highly seasonal and affected by weather conditions, animal health, and feed costs. These factors impact milk supply and, consequently, the prices of dairy products.

Regional Demand Patterns: As noted, New Zealand is a major exporter to Asia, where demand for dairy products is growing. In contrast, the U.S. market focuses more on cheese and other domestic dairy needs. This regional demand discrepancy often drives price differences across products and exchanges.

Global Trade and Tariffs: International dairy trade can be affected by tariffs, trade agreements, and geopolitical tensions. For example, New Zealand’s access to Asian markets or potential trade barriers in the U.S. can influence dairy prices.

The dairy market is a unique and complex space within commodities trading, driven by regional differences, supply chain dynamics, and consumer preferences. For newcomers, understanding the basics of products available on SGX and CME, and how regional factors can lead to price discrepancies, is a good starting point. While this article provides a simple introduction, it’s worth noting that the dairy market is intricate and nuanced, with many variables influencing prices.

Executing the plays

A hypothetical investor can consider the following two trade1:

Case Study 1: Short SGX-NZX Global Whole Milk Powder (WMP) December 2024 Futures, Long SGX-NZX Global Whole Milk Powder (WMP) January 2025 Futures

We would consider taking a short position in the December 2024 WMP futures contract and a long position in the January 2025 WMP futures contract, based on the following observations:

As seen in Figure 4, the WMP market generally exhibits a contango structure, where longer-dated contracts trade at a premium over nearer-term ones, typically represented by a calendar spread trading below 0.

Currently, the December-January WMP calendar spread is trading at 0, suggesting a potential opportunity to capitalize on the spread reverting back to contango.

Each 1-point move in the WMP futures results in a profit or loss of USD 5.

Case Study 2: Short SGX-NZX Global Whole Milk Powder (WMP) Futures, Long SGX-NZX Global Skim Milk Powder (WMP) Futures

As shown in Figure 5, the spread between WMP and SMP tends to mean-revert, presenting a potential trade opportunity:

The current spread between WMP and SMP is trading at the upper threshold.

To capture this mean-reversion, we could take a short position on the WMP futures and a long position on the SMP futures, aiming for the spread to narrow as it returns to its historical range.

Both WMP and SMP futures have a contract size of 1 metric tonne, with each 1-point move valued at USD 5.

Original Link: https://www.sgx.com/research-education/market-updates/20241104-derivatives-traders-playbook-overview-dairy-market

Examples cited above are for illustration only and shall not be construed as investment recommendations or advice. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios.