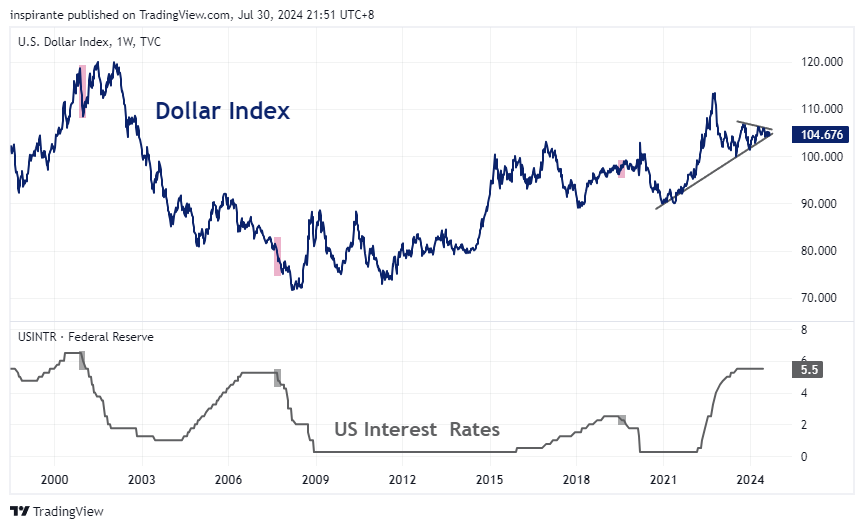

This week is packed with major central bank meetings, and hints of policy normalization will be key points to watch, particularly in terms of the dollar’s reaction.

The current consolidation of the dollar reflects macroeconomic uncertainty, driven by the upcoming US election season and the Fed’s impending decisions.

The weakness in the Chinese economy is pronounced when looking at the FTSE China A50, which has been on a downtrend since 2021. Prices are now trading below the primary trend support

On a shorter-term timeframe, the China A50 Index has completed a head-and-shoulders pattern and broken below its neckline, indicating further potential downside.

The underperformance of the China A50 is more pronounced when compared against other Asian economies, with only Thailand performing worse. In contrast, India stands out as the best performer.

Examining various economic indicators for China and India highlights China's relative weakness. China's year-over-year GDP and Composite PMI are significantly lower compared to India, and its population growth has slowed down considerably. This economic slowdown contrasts sharply with India's more robust performance.

The current consolidation in the FTSE Vietnam 30 Index also looks intriguing as prices hover around the support level. Historically, reaching this support level has coincided with the RSI indicating oversold conditions, suggesting a potential rebound.

As expected, the India/China ratio stands out as the outperformer, reflecting India's robust economic growth and market performance relative to China. Notably, the Vietnam/China ratio is the weakest among the compared indices. However, this ratio is trading on a well-supported uptrend.

What’s inside our playbook?

This week marks a critical juncture for global markets as major central banks prepare to announce their policy decisions. The Bank of Japan (BOJ), Federal Reserve (Fed), and Bank of England (BoE) are all set to meet, creating a pivotal period for currency markets and the global economic outlook.

The Federal Reserve's decision is particularly significant, given the dollar's recent consolidation. This consolidation reflects broader macroeconomic uncertainty, further complicated by the approaching U.S. election season. Market participants are closely monitoring any hints of policy normalization, which could have far-reaching implications for global markets.

The weakness in the Chinese economy is becoming increasingly apparent, as evidenced by the performance of the FTSE China A50 Index. Issues such as the deflating real estate bubble, economic slowdown, and potential geopolitical tensions weigh heavily on the market. The recent third plenum of the Chinese Communist Party’s (CCP) Central Committee offered little to no indication of policies addressing near-term growth challenges.

When comparing the Chinese Index against other Asian peers, the underperformance becomes pronounced. Over the past year, China has been the second worst performer, only surpassed by Thailand, while India stands out as the best performer among the compared indices. We covered the India-China divergence in September last year and since then, India has continued to outperform China in measures such as year-over-year GDP growth and Composite PMI. From a demographic perspective, the population growth trends of the two economies have begun to diverge significantly, with 2024 estimates showing India’s population clearly ahead of China and still trending higher, while China's population trend appears to be headed lower.

Viewed from this lens, the backdrop for China, both in the short and long term, looks troubling. The recent bearish price action, where the FTSE China A50 Index continued to trade lower after breaking below its long-term trend support, as well as completing a head-and-shoulders pattern on the shorter timeframe, points toward more potential downside for the Chinese index.

From a ratio perspective, the Vietnam/China Index ratio remains the weakest among the other indices compared to China. However, this presents a unique opportunity. If the current trend support for the FTSE Vietnam 30 Index holds and the RSI suggests it is oversold, there could be potential for a rebound. For those with less conviction about Vietnam's standalone potential, trading the Vietnam/China ratio offers a hedged approach. This strategy allows investors to capitalize on Vietnam's potential upside relative to China while mitigating broader market risks. The well-supported uptrend in the Vietnam/China ratio suggests that this could be a compelling trade to consider.

Executing the plays

A hypothetical investor can consider the following two trade1:

Case Study 1: Short SGX FTSE China A50 Index Futures (CN)

We would consider going short the FTSE China A50 Index Futures given the;

Structural weakness in the Chinese economy.

Completion of the head and shoulder pattern on the FTSE China A50 Index.

Break of the long-term primary trend support.

Hence we can express a short position on the FTSE China A50 Index Futures at the current level of 11,643, stop at 12400, and take profit at 10800. Each 1-point move in the FTSE China A50 Index Futures contract is 1 USD.

Case Study 2: Long SGX FTSE Vietnam 30 Index Futures (FVN), Short SGX FTSE China A50 Index Futures (CN)

We would consider going long the ratio of the Vietnam 30 Index to the China A50 Index by taking a long position on the FTSE Vietnam 30 Index Futures and a short position on the FTSE China A50 Index Futures given the;

Likely weakness in the China A50 Index, as highlighted in Case Study 1.

The Vietnam 30 Index is trading at trend support, with the RSI indicating it is potentially oversold.

The Vietnam/China Index ratio is the weakest performer relative to other Asian indices versus the China Index.

At current prices, the notional value of the FTSE China A50 Futures is approximately 11,858 USD, while the notional value for the FTSE Vietnam 30 Futures is around 8,965 USD. To closely match the notional value of both futures, we can trade at a ratio of 3 CN : 4 FVN, resulting in an exposure of roughly 35,600 USD on each leg. The current price levels of both index futures result in an entry price ratio of 0.1512. Each 1-point move in the FTSE China A50 Index Futures contract is equivalent to 1 USD, while each 1-point move in the FTSE Vietnam 30 Index Futures is equivalent to 5 USD.

Original Link: https://www.sgx.com/research-education/market-updates/20240731-derivatives-traders-playbook-some-weakness-ahead

Examples cited above are for illustration only and shall not be construed as investment recommendations or advice. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios.