What is gold, really?

Gold occupies a unique position in the financial market.

It has not only been a cornerstone of wealth and prosperity but also one of humanity's earliest forms of money. In the realm of economics, "money" is traditionally defined by its three functions: a store of value, a unit of account, and a medium of exchange. Gold remarkably satisfies all these criteria, standing out across time as the quintessential form of money. While history has seen various objects and materials serve as currency—from shells to grains—gold has consistently outperformed these alternatives. Its superiority can be attributed to several intrinsic characteristics: durability, portability, divisibility, uniformity, limited supply, and widespread acceptability. These attributes ensured that gold remained the preferred standard for centuries, facilitating trade, wealth storage, and economic stability across civilizations.

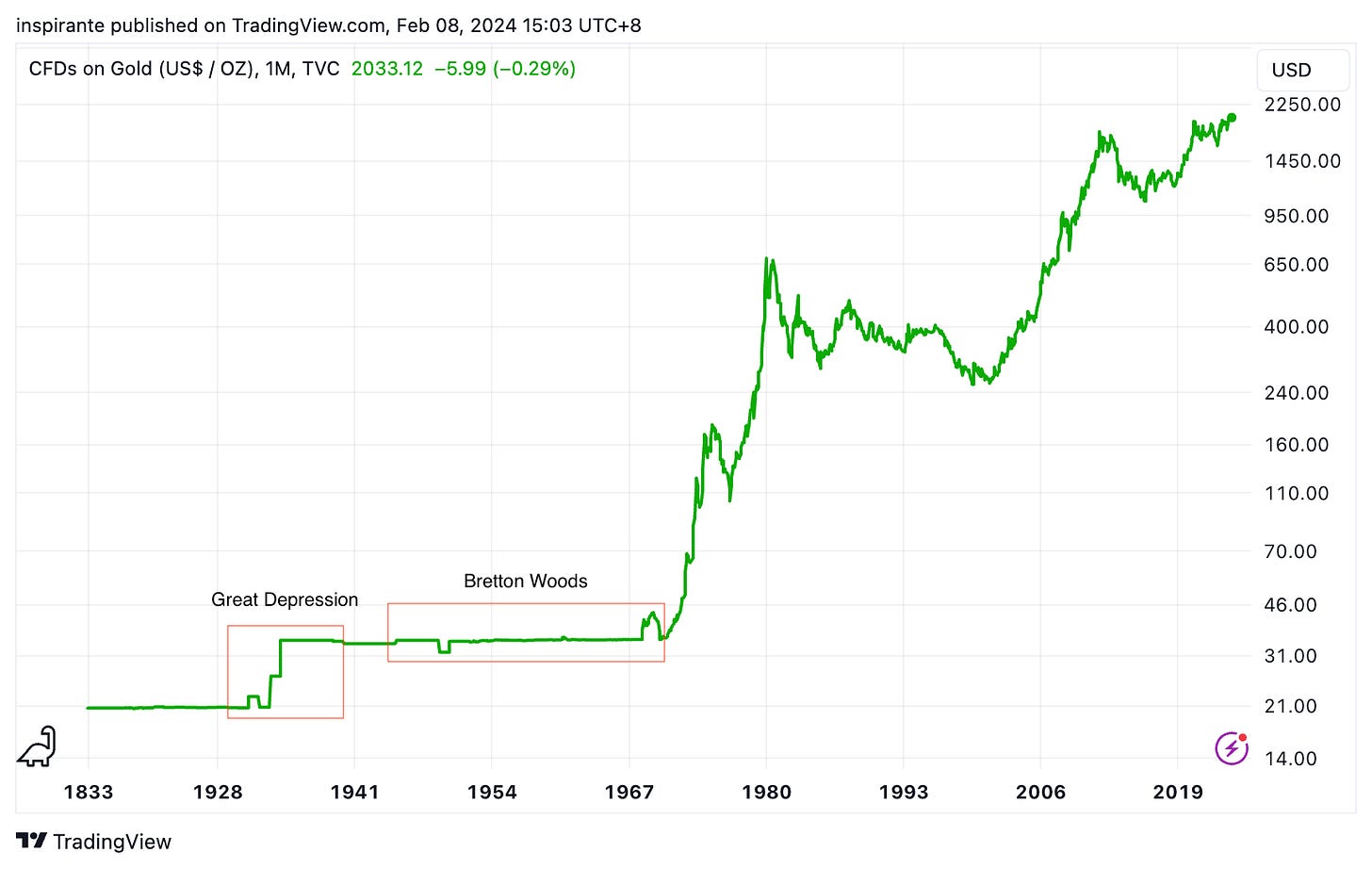

The journey of gold in the United States offers a fascinating glimpse into its evolving role within the global financial system. Before the Bretton Woods agreement in 1944, gold played a central role in the U.S. monetary system, backing the value of the dollar and instilling confidence in the nation's currency. The Bretton Woods system itself was a testament to gold's enduring value, establishing fixed exchange rates anchored by the U.S. dollar's convertibility into gold. However, the dissolution of Bretton Woods in 1971 marked a pivotal shift, severing the direct link between gold and fiat currencies. This transition heralded a new era of monetary policy, characterized by floating exchange rates and the dominance of fiat currencies.

In the post-Bretton Woods era, perceptions of gold have undergone significant transformation. Increasingly, individuals question gold's relevance in a modern financial portfolio, with some dismissing it as a "barbaric relic" of a bygone era. This skepticism reflects broader changes in monetary policy, economic theory, and investment strategy. However, such views overlook gold's enduring attributes and its historical resilience as a store of value. Gold continues to play a crucial role in diversifying investment portfolios, hedging against inflation, and serving as a safe haven in times of economic uncertainty. It remains a critical asset for investors seeking to preserve wealth over the long term, embodying a form of "true" money that transcends the limitations of contemporary fiat currencies.

What influences gold price?

Understanding the factors that influence gold prices is crucial for any analysis of its role in the financial markets. While it's a common perception that the U.S. dollar significantly affects gold prices—given that gold, like many commodities, is denominated in USD—this relationship exhibits variability over time. A nuanced examination reveals that the correlation between gold prices and the U.S. dollar (often tracked using the U.S. Dollar Index, DXY, as a proxy) is not consistently strong across all periods. For instance, from early 2022 to the beginning of 2024, the correlation between gold and the DXY has been marked with periods of synchronicity and divergence (Figure 3), suggesting other drivers at play in determining gold prices.

One such factor, for example, is the real yield on U.S. 10-year Treasury notes, calculated as the nominal yield minus inflation expectations. Real yields offer a more accurate measure of the investment's return, adjusting for the effects of inflation. Historically, there has been a noticeable inverse correlation between real yields and gold prices. The rationale behind this relationship is straightforward: as real yields increase, the opportunity cost of holding non-yielding assets like gold becomes higher, typically leading to lower gold prices, and vice versa. However, this correlation is not perfect, and periods of divergence have been observed, indicating the influence of other market dynamics and sentiments.

Another pivotal factor influencing gold prices is demand, encompassing both investor sentiment and central bank policies. Traditionally, gold has been a staple in investment portfolios and a key component of national reserves. The appeal of gold to investors can fluctuate based on generational trends, economic outlooks, and the emergence of alternative investment vehicles. For example, recent years have seen a shift among newer generations of investors towards digital assets like Bitcoin, which offer a narrative of scarcity and value preservation similar to gold. This shift has influenced gold demand and, consequently, its price.

Furthermore, the behavior of central banks significantly affects gold prices. While major G7 countries have not shown a marked increase in their gold reserves in recent years, the BRICS+ countries (Brazil, Russia, India, China, South Africa, and their allies) have been aggressively boosting their gold holdings. This trend underscores a strategic move towards diversification and a hedge against currency and economic uncertainties, highlighting gold's enduring appeal as a reserve asset.

Is there a better way to view gold?

In understanding gold's significance, it's crucial to look beyond conventional views of this precious metal as merely another commodity denominated in fiat currencies. Instead, by adopting a lens where gold serves as the primary unit of account and the truest store of value, we uncover profound insights into its enduring worth. This shift in perspective reveals that fiat currencies, which lack backing from scarce resources like gold or oil, are inherently vulnerable to the erosive effects of central bank policies and governmental monetary expansion, commonly referred to as "money printing." Over time, these policies diminish the purchasing power of fiat currencies, whereas gold consistently preserves wealth.

By examining the ratio of the Dow Jones Industrial Average to gold, we observe the number of ounces of gold required to buy a unit of the stock market over several decades. Remarkably, despite the stock index increasing more than 360 times in value, this ratio remains around its historical average. This consistency underscores gold's capacity to maintain purchasing power, illustrating its stability amidst the volatility of equity markets.

Similar analyses of the Nasdaq and the Russell 2000 indices through the prism of gold reveal analogous outcomes. The Nasdaq-to-gold ratio, while currently on the higher end of its historical range, has not reached the extreme peaks of the DotCom bubble, indicating gold's resilience. The examination of the Russell 2000, representing smaller cap stocks, further confirms gold's ability to safeguard value over time, across various market sectors, from tech darlings to small caps.

Turning to real estate, the ratio of the average U.S. home price to gold provides insights relevant to everyday citizens. Despite a more than tenfold increase in home prices since the 1970s, the amount of gold required to purchase an "average home" remains within historical norms, which is between 150 and 400 in terms of the ratio. This example vividly demonstrates gold's effectiveness in preserving purchasing power in the face of real estate market inflation.

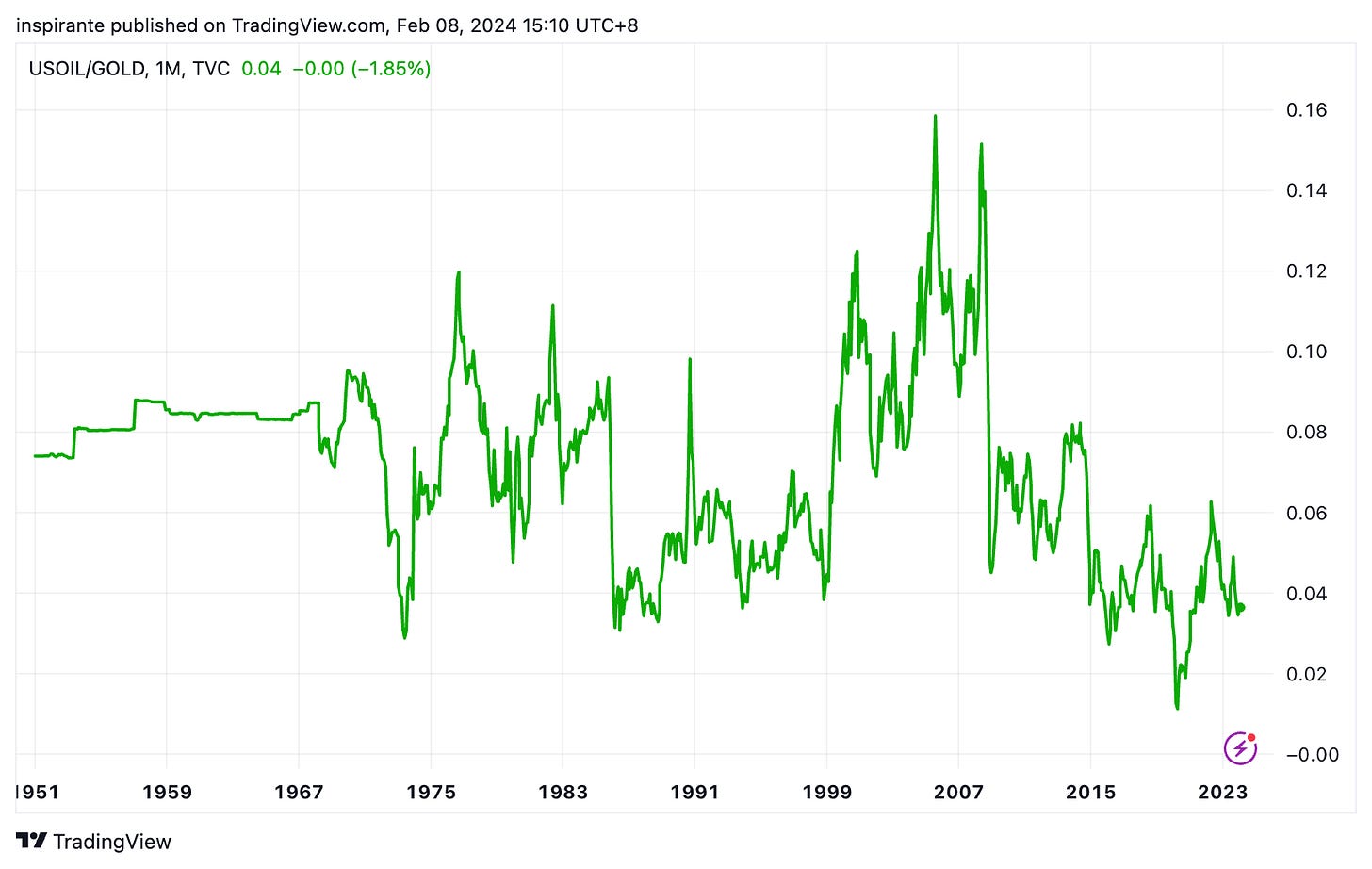

When examining gold's value relative to oil—a commodity of paramount importance to the global economy—the stability of this relationship is striking. The number of ounces of gold needed to purchase a barrel of oil has remained remarkably consistent over decades, between 0.04 and 0.10 in terms of the ratio, despite geopolitical upheavals and unexpected global events. This stability affirms gold's role as a reliable measure of value across different economic sectors.

Now, let's turn our attention abroad. India's equity market, particularly as represented by the Nifty 50 index, has attracted considerable attention from global investors due to its impressive performance in recent years. However, when we examine the ratio of the Nifty to gold, adjusting for local currency (INR) fluctuations, we find that the market's valuation remains within its historical range, albeit at the higher end. This observation suggests that, despite the market's nominal gains, its value relative to gold—and thus its true purchasing power—has remained stable, highlighting gold's role as a reliable benchmark for assessing asset values beyond the influence of currency volatility.

The Japanese equity market presents another compelling case study in the context of currency depreciation. When evaluated in yen, Japanese equities may appear to offer significant returns, particularly given the yen's sharp depreciation against the USD (USDJPY went from 75 in 2012 to 150 in 2023). However, viewing these returns through the lens of gold reveals a different story. Adjusted for gold, the Japanese equity market does not appear "expensive" from a historical perspective, emphasizing how currency fluctuations can distort perceived investment gains. For foreign investors, particularly those not hedging currency risk, the real value of their Japanese equity holdings, when measured against gold, may reveal that much of their nominal gains are offset by losses in currency purchasing power.

Turkey's equity market exemplifies the extreme effects of currency depreciation on investment returns. In local currency terms, the market experienced a surge of over 900% since the low of 2020. However, when converted to USD, the gain is markedly lower at 120%, and when measured in gold terms, the increase is a mere 60%. This stark discrepancy underscores the illusion of performance driven by depreciating fiat currencies. The Turkish example vividly demonstrates how fiat currency devaluation can erode real investment returns, reinforcing the argument for gold as a more stable and reliable measure of long-term value preservation.

Where is gold heading?

The journey through gold's storied past and our reassessment of its value proposition fortify our conviction in gold's enduring relevance. This conviction aligns us with the long-term bullish camp, advocating for gold's inclusion in investment portfolios for both value preservation and potential appreciation. Echoing the sentiments of renowned financial commentator Jim Grant, we view gold not merely as an inflation hedge but as a prudent investment in an era marked by monetary disorder—a condition all too prevalent in today's global economy.

Despite our optimism for gold's long-term prospects, a discerning approach to market dynamics and price action remains paramount. The gold market, like all financial markets, is subject to fluctuations.

Gold's price action over the past decade suggests the formation of a multi-year Cup-and-Handle pattern, a bullish continuation signal, with the metal now poised at the critical juncture of a breakout from this formation's neckline. Currently trading near its all-time high above $2,000 per ounce, gold faces a significant resistance at the $2,100 level—a threshold that has thrice rejected its advances since 2020, each followed by a correction exceeding 10%.

Scanning through the volatility landscape of major asset classes, as measured by the CME Group Volatility Index (CVOL), reveals a particularly noteworthy aspect of gold's market behavior: its subdued implied volatility. Historically, periods of heightened implied volatility in gold have coincided with significant market events—such as the pandemic response in mid-2020, the Russia-Ukraine conflict in 2022, and the economic downturns of 2023. These events typically led to volatility spikes, which were often short-lived and followed by rapid price adjustments. However, the current market environment presents a contrast. As gold surpasses the $2,000 level, the absence of a corresponding increase in volatility suggests a market that is either confident in the metal's valuation or perhaps somewhat complacent about the broader macroeconomic backdrop. This relatively calm ascent, not driven by a single, disruptive event, further bolsters our confidence in gold's potential for sustained growth. Moreover, the current low-volatility environment opens up opportunities for employing options strategies, allowing us to navigate the market's complexities with greater finesse.

In a shorter timeframe, however, gold is converging towards the apex of a symmetrical triangle, signaling a potential inflection point. Diminishing upward momentum and the risk of breaching the triangle's support hint at the possibility of a dip below the $2,000 mark. We remain cautious in the short term.

A pivotal factor in gold's immediate trajectory is the divergence between gold prices and real yields. Recent increases in real yields, driven by higher nominal yields and tempered inflation expectations, present a headwind to gold's ascent. The market anticipation of Federal Reserve rate cuts and a consequent decline in bond yields—if unmet in the near term—could challenge gold's ability to break through its current resistance. This scenario may precipitate a short-term correction, underscoring the need for vigilance in the coming months.

Our analysis so far—spanning gold's historical significance, its intrinsic value, technical patterns, and the current volatility landscape—culminates in a nuanced outlook: while short-term caution is warranted due to potential reversals and the challenges posed by real yield dynamics, the long-term perspective remains overwhelmingly positive.

How do we express our views?

We consider expressing our views via the following hypothetical trades1:

Case study 1: Short gold futures

If we have a short-term bearish outlook on gold, we would consider taking a short position in gold futures (GCJ4) at the current level of $2,030, setting a stop-loss above $2,090, which could bring us a hypothetical maximum loss of 60 points. Looking at Figure 17, should the symmetrical triangle breakout be confirmed, gold price has the potential to fall to $1,870, a hypothetical gain of 170 points. Each gold futures contract represents 100 troy ounces of gold. Additionally, a micro gold futures contract is available, sized at 1/10 of the standard contract.

Case study 2: Long crude oil/gold ratio

If we are cautious about gold in the short-term due to the technical setup (Figure 17) and the real yield dynamics (Figure 4), yet, at the same time we want to protect ourselves from potential further depreciation of the fiat currencies and their loss of purchasing power, we could take advantage of the relatively low crude oil / gold ratio. In the historical context, crude oil appears relatively "cheap" compared to gold at the moment; therefore we would take a long position in the ratio by buying three crude oil futures (CLJ4) at $77 and selling one gold future (GCJ4) at $2,030. Each gold futures contract represents 100 troy ounces of gold and each crude oil futures contract represents 1000 barrels of crude oil. The initial price ratio is 77 / 2,030 = 0.0379. By maintaining a three-to-one quantity ratio, the notional values of both positions are approximately equalized (3 x 77 x 1,000 = USD 231,000 for crude oil and 2,030 x 100 = USD 203,000 for gold). Should the ratio return to the historical average of 0.07, as suggested by Figure 10, and assuming gold's price remains constant while crude oil appreciates to 142.1 for easy calculation (the ratio would be 142.1 / 2,030 = 0.07), the theoretical profit, which all comes from the crude oil position, would be 3 x (142.1 – 77) x 1,000 = USD 195,300. A stop-loss would be set at a ratio of 0.03, with a hypothetical scenario where the crude oil price remains unchanged and gold appreciates to 2,566 for easy calculation (the ratio would be 77 / 2,566 = 0.03), resulting in a loss from the gold short positions, calculated at (2,566 – 2,030) x 100 = USD 53,600.

Case study 3: Long gold call options and short gold futures (delta neutral)

If we are bullish on gold in the short term but concerned about downside risks, we would consider establishing a delta neutral position. This involves buying two at-the-money calls that expire in late March (OGJ4 C2030) at 34.3 points and selling one gold future (GCJ4) at the current level of $2,030. The implied volatility for these calls is 12.5%, and their combined delta is approximately 1. Adding a short gold future (which has a delta of -1) achieves delta neutrality. At the option expiry, the position would be in profit if the gold futures price is above $2,030 + 34.3 x 2 = $2,098.6 or below $2,030 – 34.3 x 2 = $1,961.4. The maximum loss happens when the gold futures price stays at exactly $2,030 at the option expiry, and the loss amount is the total premium paid of 34.3 x 2 = 68.6 points. Each point move in both gold option and future is USD 100. Before the option expiry, an implied volatility increase would benefit the option price, other things being equal. The payout diagram below is generated by QuickStrike's Strategy Simulator.

Case study 4: Long gold strangles

If we are bullish on the gold's implied volatility but do not have a strong directional bias in the short term, we would consider establishing a strangle position that expires in late March. We would buy one out-of-the-money put (OGJ4 P2020) at 28.8 points and one out-of-the-money call (OGJ4 C2040) at 30 points, for a total of 58.8 points. The implied volatilities for the put and the call are 12.38% and 12.6% respectively. Upon establishment, the position is delta neutral. At the option expiry, the position would be in profit if the gold futures price is above $2,040 + 58.8 = $2,098.8 or below $2,020 – 58.8 = $1,961.2. The maximum loss happens when gold futures price stays between $2,020 and $2,040 at the option expiry, and the loss amount is the total premium paid of 58.8 points. Each point move in gold options is USD 100. Before the option expiry, an implied volatility increase would benefit the option price, other things being equal. The payout diagram below is generated by QuickStrike's Strategy Simulator.

Original link here.

EXAMPLES CITED ABOVE ARE FOR ILLUSTRATION ONLY AND SHALL NOT BE CONSTRUED AS INVESTMENT RECOMMENDATIONS OR ADVICE. THEY SERVE AS AN INTEGRAL PART OF A CASE STUDY TO DEMONSTRATE FUNDAMENTAL CONCEPTS IN RISK MANAGEMENT UNDER GIVEN MARKET SCENARIOS. PLEASE REFER TO FULL DISCLAIMERS AT THE END OF THE COMMENTARY.