Flipping through the markets

The end of November marks the launch of the T+1 sessions for the SGX-listed United States Single Stock Futures. The upcoming launch will feature close to 21 hours of access for TSMC, SEA, and Grab Single Stock Futures, overlapping with the listed stock which trades from 10:30 pm to 5:00 am Singapore time.

Before delving into the intricacies of Single Stock Futures (SSF), let's understand their fundamental appeal. Futures trading is attractive for its margin efficiency, demanding lower capital to establish positions. Furthermore, when paired with related products, futures can benefit from margin offset, further reducing capital requirements. They also simplify the process of taking long or short positions in the market.

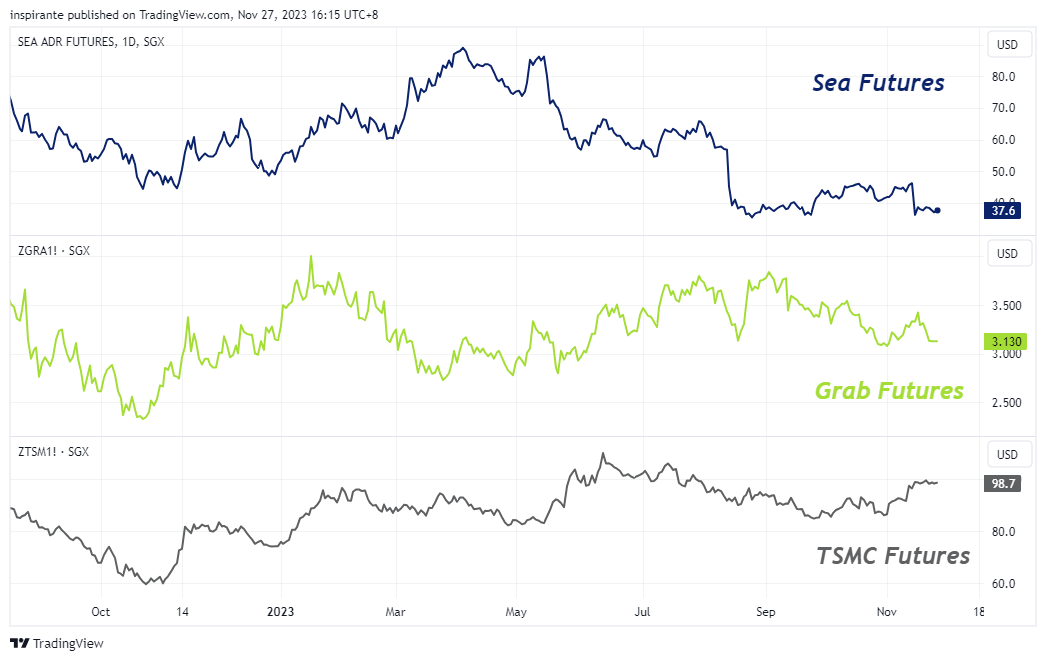

With 11 SSFs now available for MSCI Singapore, traders can replicate nearly 80% of the index's constituents. This opens up the door for portfolio replication or sector replication style strategies. Here, we show the variance in volatility and price action of the sub components of the MSCI Singapore Index, such as the Financials vs the US listed Singapore Tech.

Focusing on the spread between the US listed products (Sea, Grab) vs the Financial sector in Singapore provides us with an interesting set up, especially so when comparing against the price analog of the US Financial sector vs the Tech. Here we see the 2 trading in tandem up until June 2023 when the relationship broke, with the Singapore’s Tech/Financials suppressed compared with the US one.

The FTSE Taiwan Index, heavily influenced by TSMC, reveals an intriguing pattern when TSMC's impact is removed. The resulting broadening triangle pattern, typically bearish, suggests potential market movements.

What’s inside our playbook?

With the launch of the Single Stock Futures (SSFs) T+1 session at the end of November, new and interesting strategies are opening up in the SGX derivatives market. SSFs include a selection of 14 Singaporean and three United States stocks, such as SEA, Grab, and TSMC. Notably, 11 of these 17 SSFs are constituents of the MSCI Singapore Index, enabling a diversified trading strategy that encompasses both individual stock movements and broader market trends.

In general, we can consider using the SSFs in three different strategic styles:

1) Exploring the Spread between SSFs and Index Futures

The introduction of SSFs offers a unique opportunity for traders to explore spread trades between these futures and Index Futures. This strategy could involve going long on specific SSFs that demonstrate strong individual potential while simultaneously shorting the Index Futures to hedge against broader market risks. Alternatively, traders could focus on specific sectors within the Index, leveraging SSFs to capitalize on individual stock performances, complemented by the index futures for overall market exposure.

For example say you are bullish on the Singapore Techs such as Grab and Sea but bearish on the Singapore market as a whole, you can trade the spread of a equally weighted portfolio of Grab and SEA against the MSCI Singapore Index to establish this view.

Alternatively, as illustrated with the FTSE Taiwan Index example in Figure 5, utilizing the spread can reveal less known chart patterns. This approach is particularly useful for indices dominated by a single company, such as the FTSE Taiwan Index where TSMC's weightage is 20%. By excluding TSMC's impact, we can uncover patterns like the broadening triangle and reduce price volatility attributed to a single stock, especially around key technical setups.

2) SSFs to form bespoke exposure to specific sector or names

More advanced strategies can be developed by forming bespoke exposure to specific sectors. This could be achieved either by self-constructing a basket of SSFs to create a customized index or by using SSFs to enhance index exposure. In the example provided in Figure 4, forming an equally weighted portfolio of Singapore Tech versus Financials—using Sea & Grab as proxies for Singapore Tech and DBS, UOB & OCBC for Singapore Financials—allows for a comparison of both and benchmarking their relative performance. This approach can also include comparisons to other economies, such as the US. Such analysis could reveal significant divergences in trends, as noted from June 2023, highlighting potential underperformance or investor biases between the Singapore Tech Index and Financials.

3) Avenue for reaction outside of US market hours

Another key advantage of SSFs, and perhaps the most significant in our view, is the ability to engage in price discovery outside standard US stock market hours. This facilitates the expression of views on individual stocks, especially when the US market is closed. With the extension of trading hours to T+1, participants no longer need to transfer to the stock but can maintain their position. This aspect is particularly crucial during events like earnings releases. For example, NVIDIA and TSMC are highly correlated companies within the semiconductor sphere. Typically, NVIDIA releases its earning results after the US market has closed. While this limits reaction on NVIDIA, the announcement happens during the SSFs T+1 session, allowing timely responses for TSMC based on industrial trends observed from the results.

In conclusion, the introduction of SGX Single Stock Futures, alongside the established Index Futures, introduces new opportunities for market participants. By leveraging the unique characteristics of each product, traders can devise sophisticated strategies that balance individual stock performance with broader market trends. These strategies, while more complex in execution, become increasingly compelling due to the capital efficiency and margin offsets provided by SSFs against Index Futures or other SGX products, which further reduce the capital requirements for deployment.

Executing the plays

A hypothetical investor can consider the following two trades1 :

Case Study 1: Short DBS (YDBS), UOB (YUOB) & OCBC (YOCB) Futures and Long Grab (ZGRA) & SEA (ZSEA) Futures

We would consider going short the equally weighted portfolio of Singapore Financial stocks using the DBS, UOB & OCBC futures, while going long the Singapore Technology Stocks using the Grab and Sea Futures, to express the view that the Singapore Technology sector is underpriced relative to the Financial Sector. To set up the trade we could sell 2 DBS, 1 UOB and 1 OCBC futures and buy 13 Grab and 22 Sea Futures to keep the nominal exposure equal. The current level for this spread would be -3130, we set the take profit at 20000 and stop at -7000 to provide a reasonable risk reward ratio.

Case Study 2: Short SGX FTSE Taiwan Index Futures (TWN) and Long TSMC Futures (ZTSM)

We would consider taking a short position on the SGX FTSE Taiwan Index Futures and Long the TSMC Futures on the development of the broadening triangle pattern, where the FTSE Taiwan Index Futures less TSMC is now approaching the top of the triangle pattern. Currently trading at 1482.75, stop at 1510.00 and take profit at 1415.00.

Original Link: https://www.sgx.com/research-education/market-updates/20231130-derivatives-traders-playbook-when-night-comes-alive

Examples cited above are for illustration only and shall not be construed as investment recommendations or advice. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios.